06/08/2007

NEWS STORY

F1 may be embroiled in spying scandals and 'Alonso-gate' but, behind the scenes, its owners look to be on the verge of making even more money.

F1 may be embroiled in spying scandals and 'Alonso-gate' but, behind the scenes, its owners look to be on the verge of making even more money.

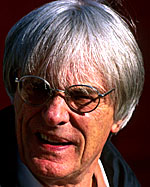

Over the last eight years shares in F1 have been sold at least six times raising around $4 billion along the way. Now it seems that the sport's boss Bernie Ecclestone and its majority owners CVC have yet another way of making money.

As Pitpass regulars will be aware, CVC borrowed a whopping $2.9 billion from the Royal Bank of Scotland (RBS) to buy F1. According to a report by Christian Sylt and Caroline Reid in Sunday's Independent newspaper, RBS is on the verge of selling the debt.

Whoever buys the debt gets a promise from F1 to pay to them $2.9 billion plus interest. Perhaps more importantly, the entire sport is secured on this loan. This means that if, for whatever reason, F1 cannot make the repayments, the debt holder could become the proud owner of the commercial rights to the sport.

The article in the Independent refers to a motorsport source saying that hedge funds are looking at buying the debt. In a nutshell, hedge funds are investors which are considered to use more aggressive strategies than even private equity companies like CVC.

Hedge funds often get huge returns through their investment strategies and it is possible that CVC may take out more debt once the $2.9 billion is sold on. This could give F1's owners yet another pay-out. Sylt and Reid write that RBS has already agreed to increase the original loan to pay off $350 million of more high-interest debt which CVC took out at the end of last year.

This all comes at a crucial time for F1. The Concorde Agreement expires at the end of this year and although a new one is said to have been drafted, it has yet to be signed. If there is no new Concorde by the start of next season, teams could theoretically leave F1 which could damage its earning potential. In fact, sources say that one of the conditions of RBS lending the money to CVC in the first place was the continued participation in F1 of the carmakers.

That said, the process of selling debt, known as syndication, is perfectly usual in the world of finance. The Independent quotes syndication strategy documents, dated the end of June, which state that "the initial banks are now entering into the syndication process." But it doesn't stop there.

Since CVC acquired F1, the sport's ultimate holding company has already changed from Jersey-based Alpha Topco to fellow Jersey-based business Delta Topco. Sylt and Reid reveal that at the heart of CVC's recent financial manoeuvrings in F1 has been a paper, prepared by accountancy firm Deloitte, called Project Gamma - Tax Structure Report. On the 19th June Gamma Topco was incorporated at the same address as Delta and Alpha Topco so yet another change does indeed look to be on the horizon.

All that lovely lolly... yet they still produce yawnfests like yesterday's 'race'.